This page will be updated to reflect the final version of the Senate bill when it’s available.

The Senate has not yet finalized its bill, but Republicans are racing to deliver a sprawling domestic policy package for President Trump that cuts taxes, boosts security funding and slashes social safety net programs to help pay for it.

Senate leaders hope to push their measure through in the coming days, but some of the proposed changes have led to feuding between Republican lawmakers in both chambers, imperiling the entire package. The bill must pass the Senate and then win final approval in the House to clear Congress.

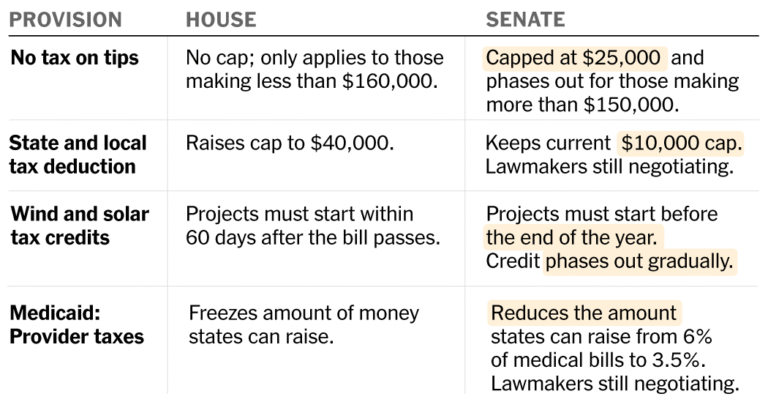

Here is a look at some of the key provisions in the bill and major differences.

Jump to a section:

Tax extensionsNew tax provisionsHealth care, food assistanceClean energyImmigration and defense

Key tax cut extensions

Many of the tax cuts President Trump signed into law in 2017 are set to expire at the end of the year. Republicans in both chambers want to extend and expand on those tax cuts, but they differ on how to do that.

Standard deduction

Both bills would raise it above its current level of $15,000 ($30,000 for couples), with adjustments for inflation each year.

House

Adds $1,000 ($2,000 for couples), from 2025 through 2028.

Senate

One-time, permanent boost of $1,000 ($2,000 for couples) in 2026.

Child tax credit

The maximum credit is currently $2,000 per child. Both bills would index the credit’s size to inflation and then make an additional increase.

House

Temporarily increases it to $2,500, starting in 2025 through 2028. Both parents need a Social Security number.

Senate

Permanently increases it to $2,200 in 2026. Only one parent needs a Social Security number.

Reporter note: To receive the full credit, families have to surpass certain income thresholds. Neither bill changes that requirement, excluding many low-income families from the full credit and the proposed additions. — Tony Romm

Estate tax

Estates worth less than $14 million are currently exempt, but this threshold is set to drop to $7 million next year.

House

Permanently exempts estates worth less than $14 million. Increases to $15 million ($30 million for couples) in 2026 with adjustments for inflation each year.

Senate

Same as House.

State and local tax deduction

The current amount of state and local taxes that can be written off on federal tax returns is $10,000, but some House Republicans in high-tax states have pushed to significantly increase the cap.

House

Raises cap to $40,000, increasing every year until 2033. The size of the cap decreases for people making more than $500,000 per year.

Senate

Keeps current $10,000 cap. Lawmakers are still negotiating this provision.

Reporter note: One of the biggest splits between the House and Senate is what to do about the $10,000 cap on this deduction. Republicans in the Senate hate SALT. They see it as a gigantic waste of money and don’t want to lift the cap much, or at all. But a committed group of House Republicans have threatened to torpedo the entire bill if the Senate backtracks significantly on the increase to $40,000. — Andrew Duehren

Deduction for business owners

Many businesses pass earnings directly onto their owners, who then pay individual income taxes on the businesses’ profits. The current deduction is 20 percent and both bills make the deduction permanent.

House

Increases it to 23 percent.

Senate

Keeps it at 20 percent.

Tax breaks for corporations

Both bills revive the ability of companies to deduct full cost of certain investments and research projects in one year rather than spreading them out over time.

House

Tax breaks, from 2025 through 2029.

Senate

Tax breaks are permanent.

Reporter note: This is a big win for big business — and economists who widely believe that these investment incentives can actually help strengthen the economy. Restoring these tax breaks has been a priority for corporate lobbyists for years. — Andrew Duehren

New tax cuts and policies

Mr. Trump also campaigned on a number of tax cuts and has pushed Republicans to include measures core to his policy agenda.

Additional deduction for seniors

Both bills create an addition to the standard deduction for Americans 65 and older. The deduction would decrease for those who earn more than $75,000 a year ($150,000 for couples).

House

Adds $4,000.

Senate

Adds $6,000.

Reporter note: One of Mr. Trump’s signature campaign promises was “No tax on Social Security.” Because actually eliminating taxes on Social Security benefits was too costly and procedurally difficult, Republicans instead settled on upping the standard deduction for seniors. — Andrew Duehren

No tax on tips

Both bills create a new tax deduction for income from tips from 2025 through 2028.

House

No cap. Only applies to those who make less than $160,000 a year.

Senate

Deduction capped at $25,000 and decreases for those making more than $150,000 a year ($300,000 for couples).

Reporter note: The Senate version cleans up a problem with the House bill, which would have barred someone making $160,001 from receiving any tax break at all. Instead of a sharp cutoff like that, the Senate winds down the tax break for people making more than $150,000. — Andrew Duehren

No tax on overtime

Both bills create a new deduction for overtime premium pay from 2025 through 2028.

House

No cap. Only applies to those who make less than $160,000 a year.

Senate

Deduction capped at $12,500 and decreases for those making more than $150,000 a year. (For couples, the deduction is limited to $25,000 and the income cutoff is $300,000.)

No tax on car loan interest

Both bills create a new $10,000 deduction for interest payments on car loans.

House

The deduction decreases for those making more than $100,000 a year ($200,000 for couples), and the vehicle must go through final assembly in the United States.

Senate

Expands the House’s rules by requiring that the car be new in order to claim the deduction.

Trump account

In both bills, babies born between the start of this year and the end of 2028 receive an investment. The Trump administration is pursuing several options to encourage Americans to have more children.

House

$1,000 deposit in a new tax-advantaged “Trump account.”

Senate

Same as House.

Tax on university endowments

Certain universities’ net investment income is currently taxed at 1.4 percent. Both bills seek to substantially raise this threshold.

House

Increases up to 21 percent.

Senate

Increases up to 8 percent.

Reporter note: Much of President Trump’s crusade against elite universities has been bogged down by legal questions or caught up in court. A tax increase passed by Congress, though, won’t face the same legal hurdles while still imposing a substantial new cost on some of the nation’s leading research universities, like Harvard. — Andrew Duehren

Charitable contribution deduction

Both bills allow taxpayers who take the standard deduction to deduct charitable donations. Historically, only those who itemize have been able to claim this deduction.

House

Allows deduction up to $150 ($300 for married couples), from 2025 through 2028.

Senate

Allows deduction up to $1,000 ($2,000 for married couples), starting in 2026 with no expiration.

Reporter note: Because Republicans have expanded the standard deduction so much, far fewer Americans have been itemizing their deductions — including their charitable donations. Some nonprofits have argued that, without a charitable deduction, Americans are not as generous of donors. This bill would again let many Americans write off their donations on their taxes. — Andrew Duehren

Cuts to health care and food assistance

To offset Mr. Trump’s desired tax cuts, both bills propose steep cuts to health care and food assistance benefits for low-income Americans.

Medicaid: Work requirements

Both bills impose a work requirement on most adults in order to qualify for benefits. States would also be required to check recipients’ eligibility twice a year instead of once.

House

Requires most adults without children to document 80 hours of work or prove they qualify for an exemption.

Senate

Expands the House’s work requirement to include adults with children who are 15 and older.

Medicaid: Provider taxes

Both bills limit strategies that states have developed to tax medical providers as a way to draw extra federal money into their budgets.

House

Freezes the amount of money states can raise.

Senate

Reduces the maximum amount that states that expanded Medicaid under the Accordable Care Act are allowed to raise to 3.5 percent of medical bills from 6 percent for most medical providers.

Reporter note: Some states heavily rely on this as a way to finance their Medicaid programs. Senators including Susan Collins of Maine, Thom Tillis of North Carolina, and Josh Hawley of Missouri have pressed G.O.P. leaders to roll back the additional cuts and to add a new fund for rural hospitals that could offset some of the money they would lose. — Margot Sanger-Katz

Affordable Care Act

Both bills make it harder to sign up for coverage or to qualify for tax credits to pay for it.

House

Imposes more rules to qualify for federal subsidies, including additional paperwork. Those with coverage may have to pay for a larger share of the costs.

Senate

Includes fewer restrictions for enrolling, but is largely similar.

Food stamps

Both bills impose a work requirement on most adults in order to qualify for benefits and shift some costs from the federal government to states starting in 2028.

House

Requires proof of work from most adults, including those with children over the age of 6, to qualify.

Senate

Walks back some of the House’s work requirement, applying it only to most adults with children 14 and older. The method for shifting costs to the states is different, too. Some states may not pay at all, depending on their error rates.

Reporter note: The nonpartisan Congressional Budget Office has said that forcing states to cover the costs of benefits could lead some states to exit the program entirely. — Tony Romm

Eliminate clean energy programs

Mr. Trump also campaigned on rolling back tax credits for clean energy contained in the Inflation Reduction Act of 2022. Both bills do this, but the Senate has proposed a more gradual phase-out for key tax credits than the House did.

Wind and solar tax credits for businesses

Both bills quickly phase out tax credits for companies that build large-scale wind and solar power plants. Solar leasing companies are ineligible.

House

Projects must start construction within 60 days after the bill’s enactment and be operational by the end of 2028 to receive tax breaks.

Senate

Projects must start construction before the end of 2025 to claim the full tax break, and the credit phases out completely by 2028.

Reporter note: Tax credits for wind and solar have become a big fight: Many House Republicans want the subsidies gone immediately, while some senators warn that ending them too abruptly could kill jobs and raise electricity prices. Wind, solar and batteries make up a vast majority of electric capacity that companies plan to add to grids in the next few years. — Brad Plumer

Other low-carbon electricity credits for businesses

Both bills phase out tax credits for companies that build other new sources of low-emissions power like nuclear reactors, geothermal plants or battery storage.

House

Battery, geothermal or other low-carbon electricity projects must start construction within 60 days after the bill’s enactment and be operational by the end of 2028 to receive tax breaks.

But businesses building new nuclear reactors could qualify for the credit as long as they begin construction before the end of 2028.

Senate

Nuclear, geothermal or battery projects qualify for a full tax credit if construction begins before the end of 2033, before phasing out completely in 2036.

Reporter note: While the Trump administration has criticized wind and solar power, Energy Secretary Chris Wright has supported power sources like geothermal and nuclear that can run at all hours but will take longer to develop. — Brad Plumer

Residential energy tax credits

Both bills end tax credits for rooftop solar, electric heat pumps and other energy-efficient home devices.

House

Ends tax credits at the end of 2025.

Senate

Ends tax credits within 180 days of the bill’s enactment.

Electric vehicle tax credit

Both bills end a $7,500 tax credit that helped reduce the cost of electric vehicles.

House

Ends the tax credit at the end of 2025.

Senate

Ends tax credit within 180 days of the bill’s enactment.

Tax credits for companies that produce clean hydrogen fuels

House

Companies must begin construction by the end of 2025 to claim credits.

Senate

Same as House.

Tax breaks for factories that make clean energy components like electric cars or solar panels

Both bills terminate credit for wind power components after 2027.

House

Excludes most companies from claiming the credit if their supply chains are connected to “foreign entities of concern,” which include China.

Senate

Retains the House’s restrictions, but narrows its definition for whether a company is tied to a “foreign entity of concern.”

Reporter note: Because China dominates global supply chains for clean energy, companies say that broad restrictions could make it extremely difficult to access tax credits. — Brad Plumer

Rescinding IRA funds

Both bills rescind an estimated $5 billion in unobligated funds from certain programs included in the IRA.

House

Also repeals the programs.

Senate

Does not repeal the programs altogether.

Increase spending on immigration enforcement and defense

Mr. Trump put immigration at the center of his political agenda and both chambers are prioritizing it. The House would steer about $175 billion toward immigration enforcement and border security. It also adds about $150 billion in new military spending.

Border wall

Both bills provide funds to build the border wall and related infrastructure, as well as improve Customs and Border Protection facilities.

House

Provides $46.5 billion for border wall and $5 billion for CBP facilities.

Senate

Same as House.

Reporter note: There has been little debate between the two chambers over increased spending to boost Mr. Trump’s crackdown on immigration, now at the center of Republican politics. — Michael Gold

Customs and Border Protection personnel

Both bills provide funds to hire and train new CBP staff, along with retention and signing bonuses.

House

Provides $4.1 billion for hiring and training new CBP staff and $2 billion for retention and signing bonuses.

Senate

Same as House.

Immigration detention facilities

House

Provides $45 billion.

Senate

Same as House.

Immigration and Customs Enforcement personnel and operations costs

Both bills fund hiring more ICE staff, transportation costs for removals and improvements to ICE facilities.

House

Provides $27.3 billion.

Senate

Provides $29.9 billion.

Boosting immigration courts

Both bills provide funds to the Justice department.

House

Provides $3.3 billion for immigration-related matters, including hiring more immigration judges and prosecuting drug trafficking as well as crimes involving undocumented immigrants.

Senate

Provides the same amount as the House, but specifies some additional uses.

Military readiness

Both bills provide funding to expand stocks of spare parts, to improve infrastructure of military depots and shipyards, and to expand capacity of Special Forces.

House

Provides $11.5 billion.

Senate

Provides $16 billion.

Munitions

Both bills provide funding to expand America’s arsenal of munitions and expand production of critical minerals.

House

Provides $20.4 billion.

Senate

Provides $23 billion.

Shipbuilding

Both bills provide funding to expand and improve America’s naval fleet.

House

Provides $33.7 billion.

Senate

Provides $28 billion.

Air and missile defense

House

Provides $24.7 billion.

Senate

Same as House.

Reporter note: Both versions of the bill provide large investments into the architecture for a missile defense shield system Mr. Trump calls “Golden Dome,” although analysts say it’s unclear whether all the funding here will be allocated for it. — Ashley Wu